The EPF contribution rate for the financial year 2021 is 85. Solved 2 The Following Table Shows The Rate Of Epf And Chegg Com.

Confluence Mobile Support Wiki

Changes to rate of workers.

. 112021 - 3062022. Employee Provident Fund Interest Rate. As a result of the announcement made on Budget 2021 the statutory EPF contribution rate for employees was reduced from 11 to 9.

01101964 to 30111978 037 on total pay on which contributions are payable. Mandatory Contribution Your mandatory contribution is calculated based on your monthly salary as an employee in accordance with the Contribution Rate Third Schedule. Employer at 12 or 13 whereas employee contributes 11 of monthly salary to the EPF.

It is a retirement scheme handled by the Employees. He cannot contribute to the scheme after the. EPF wages means the contribution made to the employee provident funds by the employee as well as the employer.

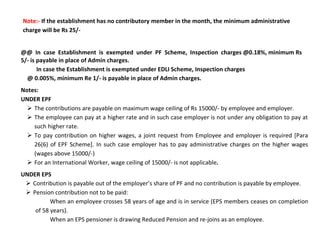

This is either 12 or 10 of the basic salary of the employee plus the. From the employers share of contribution 833 is contributed towards the Employees Pension Scheme and the remaining 367 is contributed to the EPF Scheme. Did you know that EPF contribution is optional since India Budget 2015.

As a result of this adjustment the overall CPF contribution rate will be 37 of which 17 is from the employers and 20 is from the employees. EMPLOYEES PROVIDENT FUND ACT 1991 THIRD SCHEDULE Sections 43 and 44A RATE OF MONTHLY CONTRIBUTIONS PART A. Previous employers EPF contribution rate was 6 per month for employees aged 60 and above while employees were required to contribute 55.

From 11 to 9. Read on to know more about EPF contribution Employees Pension Scheme and insurance. EPF contribution rate is the proportion at which the employer and employee contributes towards EPF.

Contribution On Epf Socso Eis In Malaysia As An Employer Bossboleh Com. The standard practice for EPF contribution by employer and employee are. Also Central Government of India contributes 11 or 6 of total wages.

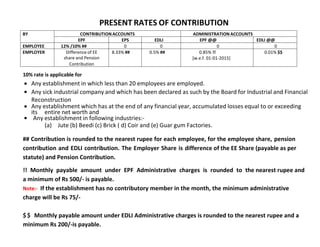

PRESENT RATES OF CONTRIBUTION BY CONTRIBUTION ACCOUNTS ADMINISTRATION ACCOUNTS EPF EPS EDLI EPF EDLI EMPLOYEE 12 10 0 0 0 0 EMPLOYER.

20 Kwsp 7 Contribution Rate Png Kwspblogs

Basic Salary More Than 15000 Eps Contribution Rejection Of Transfer Or Epf Claim

Confluence Mobile Support Wiki

Epf Interest Rate From 1952 And Epfo

Epf Interest Rate Fy 2021 22 Historical Epf Rates 1952 To 2022 Basunivesh

Confluence Mobile Support Wiki

Govt Reduces Pf Administrative Charges Effective From Jan 2015 Sap Blogs

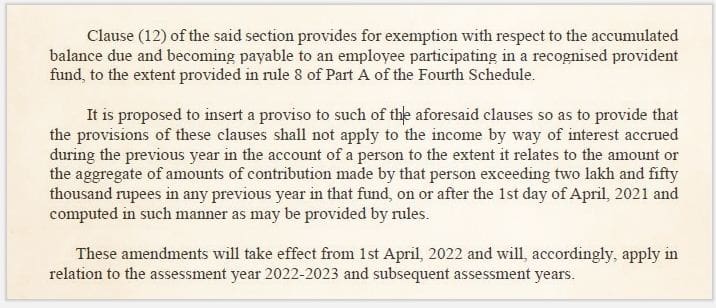

Tax On Epf Vpf Contribution Above 2 5 Lakhs

Reductions Of The Rate Of Employees And Employers Contributions To Employees Provident Funds Epf Clarification Employment Contribution Fund

Confluence Mobile Support Wiki

Epf Interest Rate 2021 22 How To Calculate Interest On Epf

New Epf Rules 2021 Latest Amendments To Epf Act

Tax Benefits On Epf Employer Employee Contribution Impact Of Withdrawal Before 5 Years Saving For Retirement Facts Money Today

Cleartax In On Twitter Income Tax Budgeting Personal Finance

Pdf Assessing The Adequacy Of Contribution Rates Towards Employees Provident Fund In Malaysia

Epf Interest Rate Fy 2021 22 Historical Epf Rates 1952 To 2022 Basunivesh

Employee Provident Fund Epf Changed Rules From 1st Sept 2014